How a White Plains judge became a favorite refuge for NYC developers

When Toby Moskovits stood to lose her trendy Brooklyn hotel to foreclosure last year, she charted a course to the suburbs.

Moskovits’ Heritage Equity Partners was fighting with its lender, Benefit Street, who claimed the Williamsburg Hotel’s $68 million mortgage was in default. Brooklyn-based Heritage turned to David Goldwasser, a fast-talking bankruptcy specialist in Florida who had earned a reputation for exploiting a loophole that allows New York City developers to file for bankruptcy in White Plains.

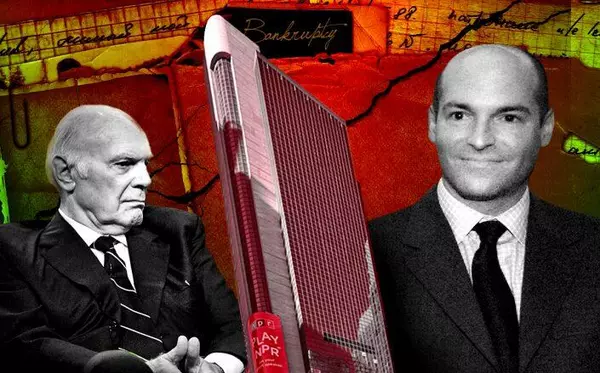

Big companies in dire straits have been known to lease offices in the quiet city to qualify to restructure there. Historically, they have known which bankruptcy judge they will get, because Westchester County only had one: Robert Drain.

This raised eyebrows last year, when Drain approved the reorganization of OxyContin maker Purdue Pharma, a company blamed for fueling the opioid crisis. Critics said that Purdue and others were “venue shopping” because Drain is thought to favor debtors.

Suspicion that firms game the system is not new. Sen. Elizabeth Warren has sponsored legislation that would limit companies’ ability to pick their court. And late last year, the Southern District of New York — which covers Manhattan, the Bronx and six suburban counties including Westchester — passed a rule to randomly assign judges to major Chapter 11 bankruptcies filed in the district, but it does not apply to entities with less than $100 million in assets or liabilities.

Drain denies that debtors file in Westchester County to get favorable rulings.

“Any assertion that somehow people chose the venue in front of me to get a particular result is just hogwash and offensive and doesn’t stand up,” he said in an interview.

Records show, however, that for years, Brooklyn and Manhattan developers flocked to Drain’s court — with a hand from Goldwasser.

An analysis by The Real Deal found that at least 33 different property LLCs tied to Goldwasser have gone through Westchester County bankruptcy court since 2013. Most of the properties are in Brooklyn or Manhattan, but there’s one as far away as Florida.

Besides the Williamsburg Hotel, Goldwasser has helped put other notable properties into bankruptcy in Westchester, including Cornell Realty’s Tillary Hotel in Downtown Brooklyn; Chaskiel Strulovitch’s 31-building Brooklyn apartment portfolio; and Raphael Toledano’s rent-stabilized East Village apartments. All saw their bankruptcy filings go through Drain.

“Any assertion that somehow people chose the venue in front of me to get a particular result is just hogwash.”

Yet he is quick to praise Drain’s expertise in handling tricky bankruptcies, calling him “one of the smartest and even-handed judges that most of the people in the country have seen.”

Legal experts, however, have raised concerns about the number of Brooklyn projects that developers have managed to get into his court.

“Why do they want to be in White Plains rather than Brooklyn? That’s the question,” said Adam Levitin, a professor at Georgetown Law specializing in bankruptcy. “What are they getting by having their cases heard by Judge Drain?”

Overruled

The Williamsburg Hotel case heard by Drain has attracted scrutiny. A U.S. trustee — essentially a watchdog of the bankruptcy process — claimed that over $1 million was transferred without appropriate court oversight and that tracking the funds was impossible because the debtor deleted information in its monthly reports.

As a result, the trustee sought to convert the case from a Chapter 11 reorganization to a Chapter 7 liquidation, leaving a court appointed representative to control the assets, or to dismiss the case altogether.

When a company files for bankruptcy, it has to open its books and subject its operations and finances to the approval of a judge. The watchdog’s allegations suggest that the debtor ignored these basic rules.

“The debtor sought protection from its creditors and accepted the benefits of bankruptcy protection,” Greg Zipes, an attorney for the U.S. trustee, wrote in the filing. “The creditors are entitled to the protections afforded by the process as well.”

Goldwasser, however, said the trustee misunderstood the situation. The management company made the transactions, he said, and should be allowed to operate freely because it is separate from the property owner.

Drain ultimately ruled against the trustee. The bankruptcy suit is still pending and the U.S. trustee filed another motion to appoint a Chapter 11 trustee after findings by a court-appointed examiner. Moskovits declined to comment.

“The U.S. trustee has had a very hard time wrapping their arms around the fact that the management company is not in bankruptcy,” Goldwasser said.

Tangled web

Filing for bankruptcy in a distant venue might look strange, experts said, but it’s legal.

“Why do they want to be in White Plains rather than Brooklyn? What are they getting by having their cases heard by Judge Drain?”

Categories

Recent Posts

GET MORE INFORMATION